Ethereum is one of the most popular and widely used blockchain platforms in the world. It is known for its smart contract functionality, which allows developers to build decentralized applications (dApps) on top of the Ethereum blockchain. Currently, Ethereum uses a consensus mechanism called Proof of Work (PoW) to secure its network and validate transactions. However, with the upcoming transition to Ethereum 2.0, Ethereum will be moving towards a new consensus mechanism called Proof of Stake (PoS).

Proof of Stake is a consensus mechanism that aims to replace the energy-intensive mining process used in Proof of Work with a more energy-efficient and secure alternative. In PoS, validators are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This means that instead of relying on computational power, validators are selected based on their economic stake in the network.

Understanding the Proof of Stake consensus mechanism

Proof of Stake differs from Proof of Work in several ways. In PoW, miners compete to solve complex mathematical puzzles in order to validate transactions and create new blocks. This requires a significant amount of computational power and energy consumption. In PoS, validators are chosen based on their stake in the network, which means that they are incentivized to act honestly because they have something to lose if they behave maliciously.

One of the main benefits of PoS is its energy efficiency. Since validators are not required to solve complex puzzles, PoS consumes significantly less energy compared to PoW. This is an important consideration given the increasing concerns about the environmental impact of cryptocurrencies. Additionally, PoS provides a higher level of security because it makes it economically irrational for validators to attack the network. If a validator tries to act maliciously, their stake can be slashed, meaning that they lose a portion or all of their staked cryptocurrency.

The benefits of Ethereum staking

Ethereum staking offers several benefits to participants. One of the main benefits is the opportunity to earn passive income. Validators are rewarded with additional cryptocurrency for their participation in the network. These rewards are typically a percentage of the total amount staked and can vary depending on factors such as network participation and validator performance. Staking rewards can provide a steady stream of income for participants, especially in comparison to the more volatile nature of mining rewards.

Another benefit of Ethereum staking is the ability to actively participate in the network. Validators play a crucial role in securing the Ethereum blockchain and validating transactions. By staking their cryptocurrency, participants contribute to the overall security and decentralization of the network. This active participation allows individuals to have a direct impact on the future of Ethereum and its ecosystem.

Requirements for becoming an Ethereum validator

Becoming an Ethereum validator requires meeting certain requirements. One of the main requirements is having a minimum stake of 32 ETH, which is the minimum amount required to participate in Ethereum staking. This minimum stake ensures that validators have a significant economic interest in the network and are incentivized to act honestly.

In addition to the minimum stake, validators also need to have technical knowledge and skills to set up and maintain a staking node. This includes understanding how to run and secure a server, as well as being familiar with the Ethereum software and protocols. Validators also need to be prepared for the responsibilities and risks associated with being a validator, such as potential slashing penalties for malicious behavior or downtime.

Setting up an Ethereum staking node

Setting up an Ethereum staking node involves several steps. First, validators need to ensure they have the necessary hardware and software requirements. This includes having a reliable internet connection, a dedicated server or computer, and sufficient storage space for blockchain data.

Once the hardware requirements are met, validators need to install and configure the Ethereum software. This includes running a client that is compatible with Ethereum 2.0, such as Prysm or Lighthouse. Validators also need to generate and manage their staking keys, which are used to sign and validate blocks.

Validators have the option to stake their ETH individually or join a staking pool. Staking pools allow multiple participants to combine their stakes and increase their chances of being selected as validators. However, it’s important to carefully choose a reputable staking pool and understand the terms and conditions before joining.

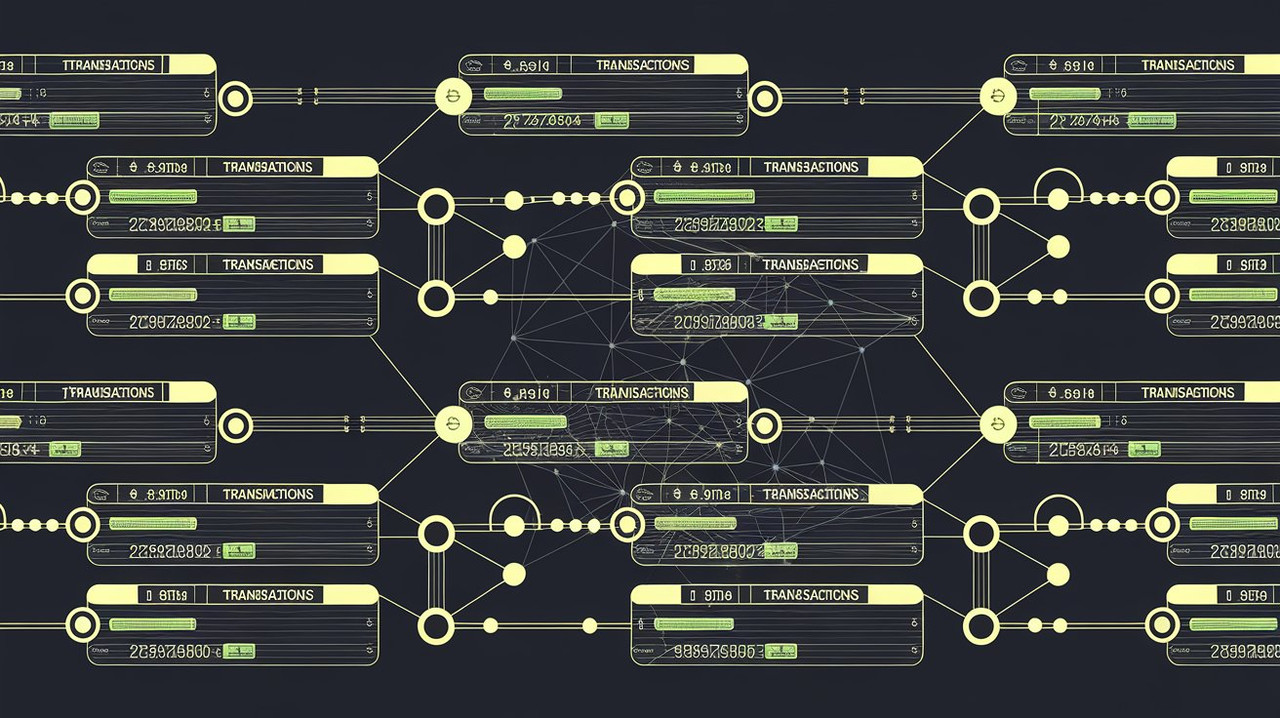

The role of smart contracts in Ethereum staking

Smart contracts play a crucial role in Ethereum staking. One of the main smart contracts used in staking is the deposit contract, which allows participants to lock up their ETH and become validators. The deposit contract acts as a bridge between the current Ethereum network and Ethereum 2.0, allowing participants to transition their ETH from the current PoW chain to the new PoS chain.

Another important smart contract in Ethereum staking is the beacon chain contract. The beacon chain is responsible for coordinating validators, managing their stakes, and organizing the consensus process. Validators interact with the beacon chain through their staking nodes, which communicate with other nodes in the network to validate transactions and create new blocks.

The use of smart contracts in staking provides several benefits. It ensures transparency and immutability, as all staking transactions and validator actions are recorded on the blockchain. Smart contracts also enable automation and programmability, allowing for more complex staking mechanisms and features to be implemented in the future.

The rewards and risks of Ethereum staking

Ethereum staking offers potential rewards for participants. One of the main rewards is the staking rewards themselves, which are earned by validators for their participation in the network. Staking rewards are typically a percentage of the total amount staked and can vary depending on factors such as network participation and validator performance. These rewards can provide a steady stream of income for validators, especially in comparison to the more volatile nature of mining rewards.

In addition to staking rewards, participants also have the potential to benefit from the appreciation of ETH. As Ethereum continues to grow and gain adoption, the value of ETH may increase over time. This means that validators not only earn staking rewards but also have the potential to see their initial stake appreciate in value.

However, Ethereum staking also comes with risks. One of the main risks is slashing, which is the penalty imposed on validators for malicious behavior or downtime. If a validator acts against the rules or fails to perform their duties, they can have a portion or all of their staked ETH slashed. This serves as a deterrent for validators to act honestly and maintain the security and integrity of the network.

Another risk of Ethereum staking is market volatility. The value of ETH can fluctuate significantly, which means that the value of a validator’s stake can also change. Validators need to be prepared for potential losses if the price of ETH drops significantly during their staking period.

How to calculate your Ethereum staking rewards

Calculating Ethereum staking rewards involves several factors. One of the main factors is the annual percentage yield (APY), which represents the annualized return on investment for staking. The APY is calculated based on the staking rewards earned and the initial stake.

The effective yield is another important factor to consider when calculating staking rewards. The effective yield takes into account factors such as network participation and validator performance. It represents the actual return on investment after accounting for these factors.

Other factors that can affect staking rewards include network participation and validator performance. If there are more participants in the network, the overall staking rewards may be lower due to increased competition. Similarly, if a validator performs poorly or has downtime, they may receive lower rewards or be subject to slashing penalties.

Best practices for Ethereum staking

There are several best practices to follow when participating in Ethereum staking. One of the most important practices is to ensure the security of your staking node and private keys. Validators should use secure hardware and software, keep their software up-to-date, and regularly back up their private keys. It’s also recommended to use a hardware wallet or cold storage solution to store your ETH securely.

Risk management is another important practice for stakers. Validators should diversify their holdings and not stake all of their ETH in one validator or staking pool. This helps to mitigate the risk of slashing penalties or losses due to market volatility. Validators should also stay informed about the latest developments in Ethereum staking and be prepared to adapt their strategies as needed.

The future of Ethereum staking and its impact on the blockchain ecosystem

The transition to Ethereum 2.0 and the introduction of Ethereum staking have the potential to have a significant impact on the blockchain ecosystem. One of the main impacts is increased participation in the network. With the lower barrier to entry and the ability to earn passive income, more individuals may be incentivized to become validators and actively participate in securing the Ethereum blockchain.

Ethereum staking also has the potential to increase network security. With more validators participating in the consensus process, the network becomes more decentralized and resilient against attacks. This increased security can help to build trust in the Ethereum ecosystem and attract more users and developers to build on top of the platform.

In terms of future developments, Ethereum 2.0 is expected to introduce new features and improvements to staking. This includes features such as shard chains, which will allow for greater scalability and throughput on the Ethereum network. Additionally, there may be opportunities for new staking mechanisms and services to be developed, further expanding the possibilities for participants in Ethereum staking.

In conclusion, Ethereum staking offers an alternative to traditional mining and provides several benefits to participants. It is a more energy-efficient and secure consensus mechanism that allows individuals to earn passive income and actively participate in the network. However, it also comes with risks and requires careful consideration of the requirements and responsibilities of being a validator. By following best practices and staying informed about the latest developments, participants can make the most of their Ethereum staking experience and contribute to the growth and success of the Ethereum ecosystem.